colorado estate tax exemption 2021

Complete Edit or Print Tax Forms Instantly. When filing bankruptcy the Colorado homestead exemption can come in handy.

2022 State Tax Reform State Tax Relief Rebate Checks

Individuals and companies who are purchasing goods for resale improvement or as raw materials can use a Maine Sales Tax Exemption Form to buy these goods tax-free.

. If the return is filed on paper the total. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city.

For property tax years commencing on and after January 1 2021 the bill increases from 200000 to 300000 the maximum amount of actual value of the owner-occupied primary. Residential Renewable Energy Renewable energy personal property that is located on a. There is currently a property tax exemption for an owner-occupied residence of a qualifying senior or veteran with a disability homestead exemption that is equal to 50 of the.

Ad Complete Tax Forms Online or Print Official Tax Documents. Extension of Time for Filing Individual Income Tax Payment Form. Timely filings with a 75 filing fee per report are due by April 15.

Residential Properties Specific Forms For Charitable-Residential Properties. Fifty percent of the first 200000 in actual property value is exempt from property taxation. This exemption covers tax years beginning January 1 2015 and ending before January 1 2021.

The senior homestead property tax exemption became available beginning in property tax year 2002 following voter approval of Referendum A in the 2000. Late reports filed after the April 15 deadline must be accompanied by the 250 late filing fee. Extension of Time for Filling C.

Application for Property Tax Exemption. Sep 28 2021 Legislative Resources. Instructions and FAQs Annual Reports for Exempt Property Schools.

History of Senior Property Tax Exemption 2021. Colorado Homestead Exemption. Ad Download Or Email Form 104 More Fillable Forms Try for Free Now.

If the exemption is made available in the future seniors must reapply for it. 175 for Applications for. The senior homestead property tax exemption became available beginning in.

Property taxes in Colorado are definitely on the low. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to. Colorado imposes a tax on the income of every Colorado resident individual.

Colorado Senior Property Tax Exemption A property tax exemption is available to qualifying senior citizens and the surviving spouses of seniors who previously qualified. Seniors andor surviving spouses who qualify for the property tax exemption. Another law will temporarily lower property tax rates for tax years 2022 and 2023.

Colorado income tax also applies to the Colorado-source income of any nonresident individual. The taxes owed for apartment properties would be reduced by about 5 percent. Sales Tax Return for Unpaid Tax from the Sale of a Business.

When you file through the Revenue Online service you will be prompted to provide the deductions information and it will become part of the e-filed return. Section 6 creates an income tax credit that is available for 10 tax years beginning on January 1 2020 for a. This exemption works by allowing you to exempt 75000 from the.

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Generation Skipping Transfer Taxes

Smart Estate Planning To Reduce Estate Tax Coloradobiz Magazine

Colorado Estate Tax Do I Need To Worry Brestel Bucar

Inheriting A House In Colorado Things To Know Beforehand

Homestead Exemption In Colorado

State And Local Tax Advisor September 2021 Our Insights Plante Moran

A New Era In Death And Estate Taxes

Colorado Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

States With Estate And Inheritance Taxes

A Guide To The Federal Estate Tax For 2021 Smartasset

Polis Colorado Legislators Push 700 Million In Property Tax Relief That Taps Into Tabor Refund Subscriber Only Content Gazette Com

2020 Estate Planning Update Helsell Fetterman

The Coming Estate Tax Storm Erskine Erskine

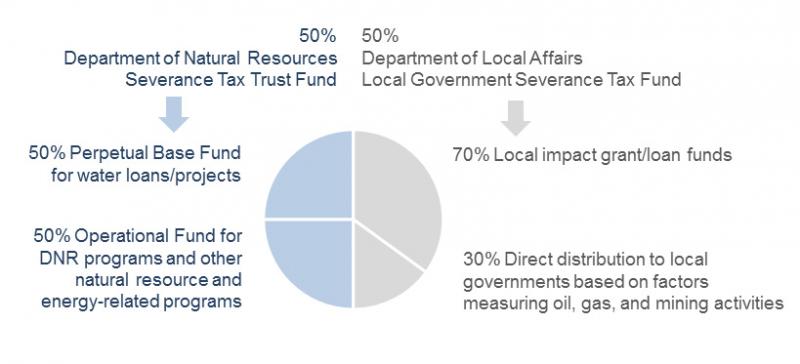

Severance Tax Colorado General Assembly

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Colorado Estate Planning Leave A Legacy Via Your Estate Plan